Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that ContextVision AB (publ) (OB:CONTX) is about to go ex-dividend in just three days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Thus, you can purchase ContextVision's shares before the 2nd of November in order to receive the dividend, which the company will pay on the 10th of November.

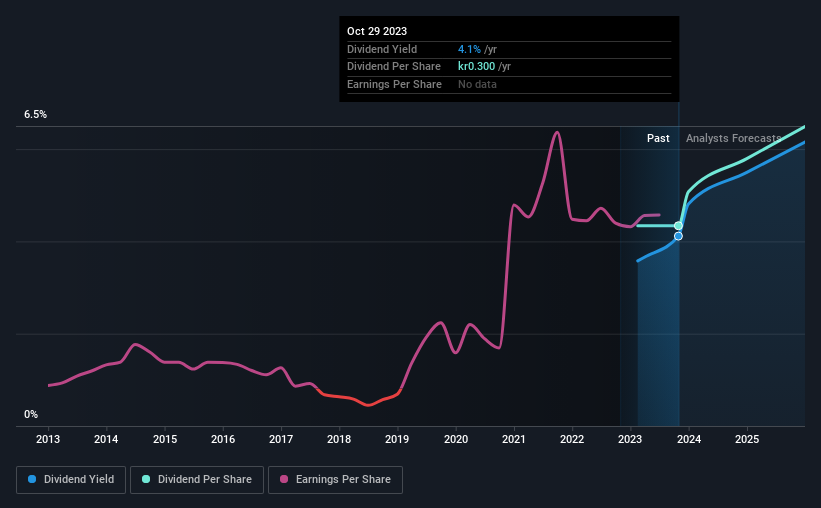

The company's next dividend payment will be kr0.15 per share. Last year, in total, the company distributed kr0.30 to shareholders. Based on the last year's worth of payments, ContextVision has a trailing yield of 4.1% on the current stock price of NOK7.3. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether ContextVision has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for ContextVision

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. ContextVision paid out 65% of its earnings to investors last year, a normal payout level for most businesses.

Click here to see how much of its profit ContextVision paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see ContextVision has grown its earnings rapidly, up 40% a year for the past five years. The current payout ratio suggests a good balance between rewarding shareholders with dividends, and reinvesting in growth. With a reasonable payout ratio, profits being reinvested, and some earnings growth, ContextVision could have strong prospects for future increases to the dividend.

Unfortunately ContextVision has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

Is ContextVision an attractive dividend stock, or better left on the shelf? ContextVision has an acceptable payout ratio and its earnings per share have been improving at a decent rate. Overall, ContextVision looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

In light of that, while ContextVision has an appealing dividend, it's worth knowing the risks involved with this stock. For example - ContextVision has 2 warning signs we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether ContextVision is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Author: Brenda Marks

Last Updated: 1699703882

Views: 1981

Rating: 4.8 / 5 (100 voted)

Reviews: 99% of readers found this page helpful

Name: Brenda Marks

Birthday: 1959-06-13

Address: 936 Beth Lights, Andersonchester, NV 85280

Phone: +4604161526913966

Job: Social Media Manager

Hobby: Role-Playing Games, Embroidery, Poker, Chess, Playing Piano, Chocolate Making, Playing Chess

Introduction: My name is Brenda Marks, I am a steadfast, proficient, accessible, candid, tenacious, unreserved, unyielding person who loves writing and wants to share my knowledge and understanding with you.